Building new standards in elderly wellbeing: Vitalis team was involved in the construction of Vitalitas Care Center

Vitalitas, one of the biggest elderly care centers in Romania, has opened its gates, drawing new directions to the understanding of caring for the seniors, in terms of facilities, location, and organizational values.

Ideally located in Ghermanesti, in the vicinity of Snagov forest, the Center consists of two interconnected buildings and can offer exclusive amenities for 380 seniors in need of attentive care, from personalized services to vast external leisure spaces.

Being among the few elderly care centers built from scratch and designed especially for senior needs, Vitalitas provides its clients with approximately 20.000 sq. m of green space in the heart of nature, including access to a garden in the Snagov forest, and an artificial lake.

Seniors may choose between taking a long walk and enjoying the silence of nature and the clean air or spending some quality time at a café or restaurant. The center also provides a cinema, board games, and beauty care services.

Moreover, the clients have 24/7 access to specialized medical staff, medical consultations, analysis and investigations, dentistry, pharmacy, medical optics and hearing devices, and saline. The on-site treatment base is equipped with modern physiotherapy devices and a hydrotherapy pool with a ramp that seniors can use under the guidance of a medical recovery specialist.

We are happy to be part of the team who made possible the development of these new standards in terms of elderly wellbeing, having the chance to use within this project our extensive experience in healthcare projects, accumulated in the over 16 years of Building Trust. Among other important projects from our medical care portfolio are the construction of a new Medicover hospital in Bucharest, The Nefromed Dialysis Center, Sfântul Spiridon Hospital in Mioveni, Amethyst Radiotherapy Center in Bucharest, Hospice Casa Speranței in Bucharest, MedEuropa Radiotherapy Centers, and many others.

Real estate deals worth EUR 1.2 bln under negotiation in Romania

Real estate investment transactions estimated at around EUR 1.2 billion are currently in various stages of negotiation in Romania as the appetite for income-generating assets remains high, according to data from a real estate consultancy company.

Since the beginning of the year, the total investment volume reached over EUR 600 million, out of which EUR 315 million was the value of deals closed in the first semester. Further transactions of around EUR 300 million were closed in July and August, a period usually characterized by lower activity, according to the same source.

The appetite for real estate acquisitions for investment purposes remains high despite the accelerated increase in bank interest rates, as institutional investors with access to capital see it as a way to protect themselves from the effects of inflation. In this context, the market liquidity remains robust, and most transactions which are currently under negotiation continue without significant changes.

Office buildings, the most traded asset class during the last four years, maintain their attractiveness amid the gradual return of employees to their offices, with strong interest also being shown towards retail parks or big box stores.

The most active segment in the first half of the year was the Office one with a 65% market share out of the total volume transacted, followed by the Retail (17%) and the Hospitality (6%) sectors.

(Source: www.romania-insider.com)

Industrial And Logistics Market in Romania in 2022

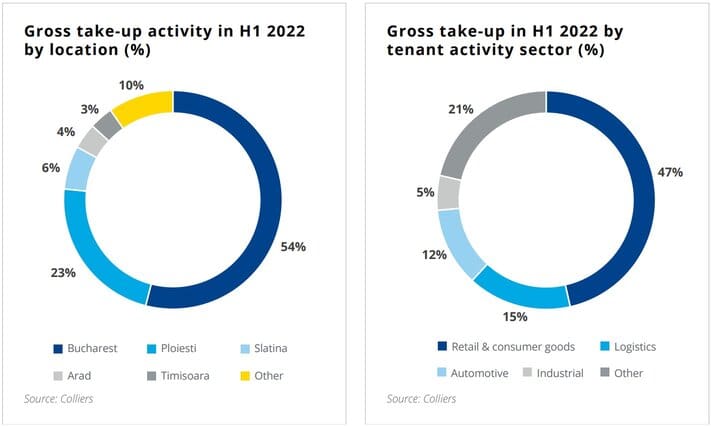

After reaching 5.6 million sq. m of modern industrial stock, Romania was just under the 6 million sq. m mark at the end of the first semester, following hefty deliveries throughout the country; while Bucharest accounted for almost half of these.

With nearly 400,000 sqm of leased deals concluded in the first semester, this is more or less comparable to what was seen last year in the first half; however, based on estimates with a partial view of unreported deals (not public), the actual volume could be at least 30% higher. Overall, a very solid first half and on track for a record-setting year.

Leasing activity continued to take place mostly in Bucharest, but with a share of 54% of leasing deals, this is already a bit smaller than what was seen in other years (for instance, in the first semester of 2021, Bucharest’s share in the total leasing volume was 69%); of course, this greatly varies from one period to another, mostly on account of what happens with the major transactions. Also, this quarter’s biggest transaction was a confidential deal for a retail tenant, located near Ploiesti, totaling close to 88,000 sq. m.

While vacancy is quite subdued, in 5-6% range throughout most of the country, such a small level has not been particularly relevant in pointing out a landlords’ market. Quite the contrary, in recent years, due to the intense competition on the supply side, rents had remained more or less constant, around 3.8-3.9 EUR/sqm in the Bucharest area and a whisker lower for other parts of the country.

This has been changing during the last couple of quarters; quotes received in the Bucharest area for new prime warehouses are in the region of 4.3 EUR/ sqm, climbing towards 4.5 EUR/sqm in exceptional cases (this would be for a “standard” leasing deal, not for SBU/small surfaces that might command even higher levels).

The change in rent is mostly on account of the higher construction costs, but it might bring a new era on the local market, with an even more generalized increase in rents (with a bump even for older schemes).

(Source: www.colliers.com)