Vitalis Consulting Provided Technical Due Diligence Services for Over 200 Projects, Exceeding 2,000,000 sq. m

The road from a Project Management company to the Leading Consultancy Company on the local and international construction market was paved with over 15 years of in-depth knowledge and understanding of the industry changes and requirements. The extended portfolio of Vitalis’ Expert Services were a result of the process.

Among the most needed expert services, Technical Due Diligence (TDD) has a high importance, being the prior step to quality achievement in any property transaction, renovations and new construction projects.

Made simple, TDD consists in a rigorous and competent expert investigation of all technical aspects of a construction project, in order to secure the future financial investment and to manage all the existent and potential risks involved.

TDD is needed for new building transactions being useful for both the owner of the existing property and the potential buyer, as well as for the refurbishment of a property or the development of a new construction project on a certain land.

Vitalis team offers TDD services for both land transactions (involving Environmental Assessment / Soil Contamination Study, Geotechnical Survey, Topographical Survey, X-Ray Survey, Utilities Prefeasibility Studies) and building transactions (documentation analysis and building assessments through site visits).

Moreover our team experts coordinate the entire Technical Due Diligence Report, implying documentation verification, results interpretation and recommendations after Site Inspection. The final TDD Report also provides cost estimation for any necessary renewal or repair works recommended in order to resolve any system deficiency.

Today we pride with over 200 projects exceeding 2,000,000 sq. m for which Vitalis team has provided Technical Due Diligence services from residential developments to office buildings, commercial galleries and industrial developments all over Romania.

The First Signs of a Come-back for The Office Market: The Pre-Lease Transactions Increase and The Renegotiations Decrease

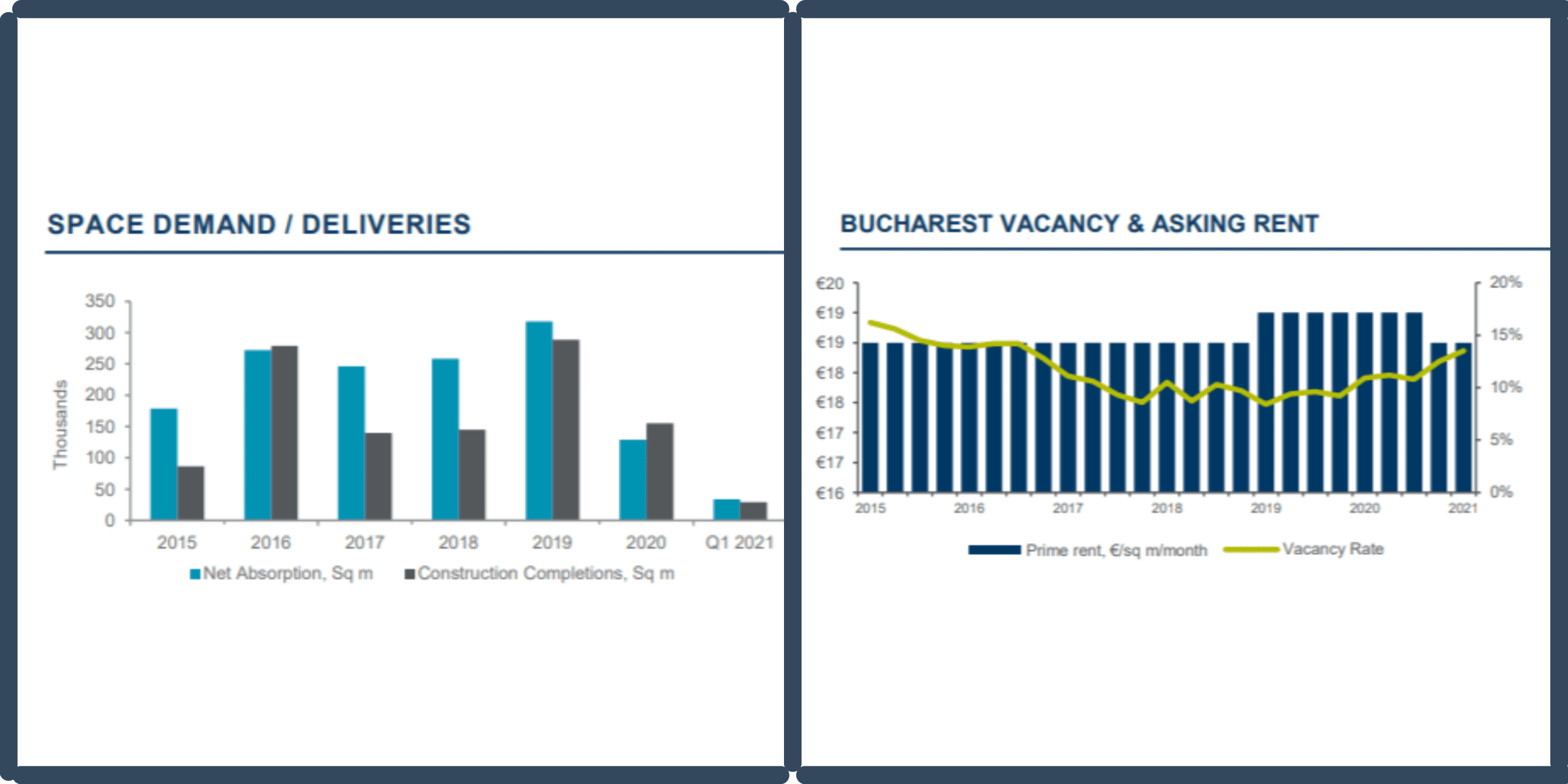

The volume of leasing transactions on the Bucharest office market increased in the first quarter of 2021 to 48,000 square meters, a 9% decrease from the similar period of the previous year, when the Covid-19 pandemic was still on its onset in Europe.

However, compared to the second half of 2020, when the market witnessed a low activity of leasing transactions, while the companies postponed as much as possible taking important decisions regarding their office location, which led to an annual 40% decrease of the transactional volume, the first signs of stability can now be observed, given a 29% share of renewal contracts compared to an annual average of 45% in 2020. Moreover, the share of pre-lease contracts increased from 20% to 46%, which shows that some companies have outlined their post-pandemic working policy and are now in a position to take decisions on the medium and long term.

The (leasing) commercial stock of office buildings in Bucharest reaches about 2.98 million square meters, other buildings with an area of approximately 150,000 sqm being occupied by the landlords, while projects with a total area of 370,000 sqm are currently under construction, being scheduled for delivery between 2021-2023.

In this context, the vacancy rate (contractual) of the office spaces is 13.5%, noting a significant difference between class A (10.7%) and class B (22.1%) office spaces. Although we are witnessing the gradual employees’ return to offices, the use of spaces degree has currently remained at a relatively low level, of about 40-50%, given that most companies prefer to continue their Work from Home or hybrid systems.

According to specialists, the first three months of this current year have brought positive signs, as we notice a significant number of pre-lease transactions of certain office spaces under construction, after a year 2020 generally marked by enhanced and delays of decisions regarding new office spaces occupancy. We also see a significant decrease of the Covid-19 cases and a positive evolution of the vaccination campaign, two key elements that will favor the return to office of many employees who will therefore feel safer at work, an essential factor for the return to a certain normality.

(Source: www.cwechinox.com)

Real estate market in better shape than expected after pandemic year

Looking back beyond the last 12 months, we can see that the pandemic has only accelerated real estate market trends that had been taking shape in this industry and in the wider economy well before the health crisis hit.

Changes in working habits, and implicitly in employees needs, started to appear before the pandemic, and this topic was already on the agenda of many management teams.

At the same time, players involved in real estate – consultants, architects, agents, engineers, developers, tenants, banks, and investors – have been expressing more interest in sustainable buildings and measures to reduce pollution.

According to specialists, the new way of working will bring up the need to adjust existing office spaces. The residential market will grow to provide occupants with a more comfortable alternative, possibly taking into account the requirements of working from home. At the same time, the industrial and logistics development market will have to accommodate the growth generated by online commerce.

All these developing areas will generate many opportunities for companies that operate in these sectors. Despite the moderate pessimism at the beginning of the pandemic, construction activity did not experience a decline, demonstrating resilience in the face of uncertainty right to the end of 2020. This year began with a slight decline in construction activity, but estimates for the rest of the year remain optimistic, forecasting a slight increase for the full year.

The demand for housing will remain strong, especially for the segments positioned at the ends of the market spectrum (low-end and high-end). Meanwhile, the middle-high category will be directly affected by postponed extension of the 5 percent VAT rate for housing, so some buyers in this category could freeze their purchasing decision at least until 2022.

The market will focus on established developers with strong financial support and with large volumes of units delivered, especially in the context generated by the adjournment of Urban Zonal Plans (PUZs) for five out of six sectors in Bucharest (2 to 6).

Institutional investors will make an entrance on the local market, and this will reshape the rental market altogether by implementing clear rules and international best practices, thus defining new rental standards.

(Source: www.business-review.eu)