How To Manage Risks When Buying a Property: Technical Due Diligence Checklist for Land Purchase

When buying a new property, either it’s a building or a land you find appropriate for future real estate developments, many risks are waiting aside. In order to certify the suitability of the property for its intended use and to be reinsured of the feasibility of your investment, you have to take into consideration three extremely important aspects in the process: the legal, urban and technical situation of the building or land you want to purchase, refurbish or reconvert.

Most properties have defects or shortcomings that could have a short, medium or long term impact on their performance and this is where you will find yourself in the need of a complex investigation concluded in a list of irregularities and suggestions for fixing the situation – a Technical Due Diligence Report.

Depending on the type of the property (commercial, residential, industrial, land, office) there are some specific aspects that must be analyzed.

The Technical Due Diligence report for land transactions have the main purpose to determine all technical limitations and factors which may have influence on the future developments on the plot and includes the following checklist:

1 – Environmental Assessment / Soil Contamination Study, 2 – Geotechnical Survey, 3 – Topographical Survey, 4- X-Ray Survey, 5 – Utilities Prefeasibility Studies, 6 – Traffic preliminary study, 7 – Verification and analysis of technical documentation, 8 – Results Interpretation and Site recommendation. If all this steps are properly followed, the result will be materialized in a Technical Due Diligence Report of reliable quality that will serve you as a risk management instrument and a financial planning tool as well.

The number of requests for a Technical Due Diligence report has become an upward trend throughout continental Europe, in Romania mostly every financial institution, investor and homeowner appointing this services before the purchasing and sale of the properties estate and lands.

Vitalis Consulting is a Technical Due Diligence advisor for more than 150 developments and plot lands from all over Romania, exceeding 1,3 million sq. m for various areas, such as: office buildings (over 600,000 sq. m), shopping malls and commercial centres (more than 450,000 sq. m), warehouses and logistic centers (over 200,000 sq. m), residential compounds (more than 50,000 sq. m), plot of lands (over 50,000 sq. m), industrial buildings (over 45,000 sq. m) and hotels (more than 30,000 sq. m).

Romania Doubled Its Industrial Stock in Half a Decade

The industrial and logistics market in Romania is currently enjoying its best period in history, both in terms of supply and demand, doubling its total stock during the past five years, according to the data from a real estate consultancy company.

The stock of industrial and logistics spaces in Romania reached a level of 3.61 million square meters at the end of H1 2019, with over 85% of these spaces being located in Bucharest, Timișoara, Ploiești, Cluj-Napoca and Pitești, cities which are all very well connected to the national motorway network.

Bucharest currently has a stock of industrial and logistics spaces of around 1.8 million square meters, with a share of 50% in the total national stock, the capital city being followed by Timișoara (500,000 sq. m), Ploiești (350,000 sq. m), Cluj-Napoca (280,000 sq. m) and Pitești (235,000 sq. m).

In the first six months of the year, new industrial and logistics spaces with an area of 200,000 square meters were delivered, with Bucharest accounting for 57% of the total (115,000 sq. m). With respect to the second part of the year, new projects totaling 300,000 square meters are expected, developers thus maintaining the impressive expansion rate that has been the main characteristic of the industrial and logistics market during the last five years.

According to real estate specialists the first semester of 2019 has been a dynamic one in terms of leasing transactions of industrial and logistics spaces, totaling 235,000 square meters. Bucharest remains the most attractive location, both in terms of total stock and the transactions concluded, but there are important transactions noticed also in Slatina and Oradea. These transactions highlight both the potential of such cities that were not among the top destinations sought after by major developers and tenants and also of the market in general, this positive trend being expected to continue in the coming years.

The vacancy rate at national level is of around 6%, the level of prime headline rents being on stable trend, standing between 3.7 and 4.1 euro/ sq. m/ month, Romania thus being one of the most competitive markets in Europe in terms of occupancy costs.

Considering the development plans announced by the major players in this market, it is expected that the stock of industrial and logistics spaces in Romania will exceed the threshold of 4 million square meters at the beginning of 2020.

(Source: www.cwechinox.com)

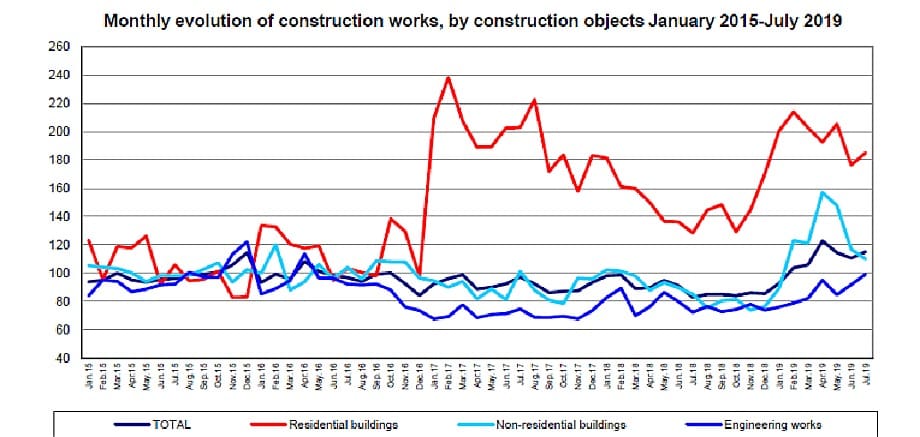

INSSE Analysis: Construction Works in July 2019

Compared to the previous month, in July 2019, the volume of construction works increased, as gross series, by 2.9% and rose, as adjusted series according to the number of working days and to seasonality, by 4.0%. Compared to the corresponding month of the previous year, the volume of construction works rose both as gross series and as adjusted series according to the number of working days and to seasonality, by 41.0% and by 38.7%, respectively.

Compared to the 1.I-31.VII.2018 period, in the 1.I-31.VII.2019 period, the volume of construction works increased, as gross series, by 26.0% and rose, as adjusted series according to the number of working days and to seasonality, by 18.8%.

By construction objects, the adjusted series according to the number of working days and to seasonality shows rises in the volume of construction works for engineering works (+8.2%) and for residential buildings (+4.9%). A decrease (-5.8%) was reported for non-residential buildings.

In July 2019, compared to June 2019, the volume of construction works increased overall, as gross series, by 41.0%. By structure elements, increases were reported for new construction works (+48.9%), for maintenance and current repair works (+37.2%) and for capital repair works (+4.9%).

By construction objects, the gross series shows rises in the volume of construction works as follows: for engineering works (+45.7%), for residential buildings (+45.2%) and for non-residential buildings (+30.1%).

In July 2019 compared to July 2018 the volume of construction works rose, as adjusted series according to the number of working days and to seasonality, by 38.7%. By structure elements, there were rises in new construction works (+45.6%), in maintenance and current repair works (+41.5%) and in capital repair works (+0.1%).

By construction objects, the adjusted series according to the number of working days and to seasonality shows increases in the volume of construction works for residential buildings (+44.1%), for engineering works (+37.4%) and for non-residential buildings (+29.2%).

(Source: www.insse.ro)