Wilo Romania Develops a New Mixed-used Building in Otopeni, Ilfov County

Wilo SE is one of the leading international manufacturers in the field of pumping systems for heating, air conditioning, cooling installation, water supply and wastewater disposal, active in Romania since 1998.

In the beginning of 2019, Wilo Romania started the development of a new mixed-used building with offices, an industrial hall and underground technical spaces, located at no. 24 Odaii Street, in Otopeni, Ilfov County, about 15 km north of Bucharest.

The project consist in the development of a 2-storey office building, a hall complex with service space, storage and an assembly line for metal parts and underground technical spaces, with a total built area of 6,559 sq. m (6,119 sq. m above ground built area and 440 sq. m underground spaces).

As a first collaboration with this client, Vitalis team was appointed to provide full construction consultancy services, both in the pre-construction and construction phase of the project, such as: Project Management, Cost Management, Site Inspection and Health and Safety Coordination.

Following Vitalis work ethic and the Beneficiary’s requirements, our main focus within this project is on building a sustainable environment, through high quality construction process and advanced features.

As a current stage of the project, the underground technical spaces are already completed.

Vitalis team is presently handling the infrastructure works for the A block of the building designed for office spaces, as well as the construction works for building’s block B superstructure, having industrial and storage destination. For the hall complex the infrastructure is completed, the prefabricated pillars are mounted and the metallic structure of the roof is currently under construction. The project is estimated to be delivered by the end of 2019.

Vitalis Consulting owns a large expertise both in industrial and mixed-used developments, as over the years the company has coordinated various projects in this sector all over the country, some of the projects being currently under construction, such as: Timisoara Airport Park II (approx. 18,000 sq. m), Pantelimon Logistic Park (5,000 sq. m), Galassini (20,000 sq. m industrial park and office spaces in Oradea), Intersnack Ghimbav Factory in Brasov (5,000 sq. m) and many others.

Romania: Industrial & Logistics Barometer in Spring 2019

The industrial and logistics market closed a less than stellar first quarter, with reported take-up of just under 30,000 sq. m versus 74,000 sq. m in 1Q18 and almost 130,000 sq. m in 1Q17. That said, we want to underscore the fact that the market is still robust, as the leasing transactions reported at Bucharest Research Forum cannot account for all direct transactions (between landlords and tenants), which do not always come to light.

Furthermore, we might be in a similar situation to last year’s, when the second semester was much more dynamic than the start of the year – the fourth quarter of 2018 alone accounted more than half of the total leasing transactions signed.

Still, construction is underway throughout the country for surfaces amounting to well over 10% of the current modern warehouse stock (we estimated that around half a million sq. m might come online this year) and most developers wouldn’t go this far as long as they didn’t notice any specific interest from tenants; speculative developments still retain a fairly low share. Furthermore, retail sales are up by 6% in 1Q19 compared to a year ago, enough to keep Romania as one of the most dynamic in the EU in terms of private consumption growth.

Wage growth has remained surprisingly sticky at above 10% for the last years (including at the start of 2019), which bodes well for consumption and, in turn, the market for storage spaces. Amid this backdrop, retailers (from fashion players to supermarkets) are expanding at a jaw-dropping pace: for instance, the largest supermarket chain in the country wants to increase its number of stores by more than twofold in the next four years.

As such, we remain confident with our call that the market can see some 0.4-0.5 million sq. m of new warehouses come online this year in spite of a seemingly soft start of the year, as our contact with market participants and our own pipeline are indicative of another strong year.

Overall, while Bucharest has remained at the forefront of demand in recent years, we believe that the market is ready to shift towards a much more diversified approach. Unfortunately, progress in terms of infrastructure works remains uneven and given the limited state budget room to accommodate such large investments, we do not expect any major breakthroughs in the next couple of years (just to detail, a breakthrough would be a complete highway on the North-South or East-West axis).

(Source: www2.colliers.com)

Investment Market in Bucharest in Q1 2019

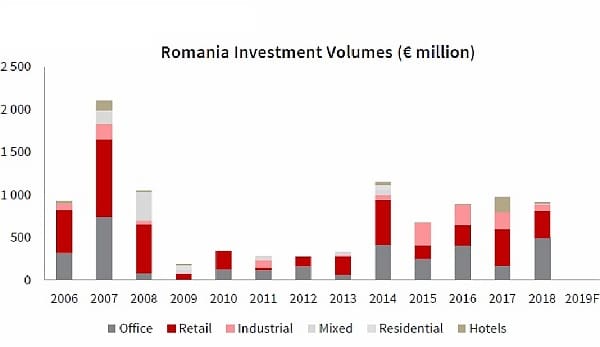

The Q1 2019 property investment volume for Romania is estimated at circa €119.5 million, a value almost three times the one registered in the same period of 2018 (€44 million). Moreover, there are a number of transactions in different stages of negotiations that will most likely be concluded during the remainder of 2019.

In comparison with Q1 2018, the number of transactions decreased, however, the average deal size increased, standing at approximately €40 million. Bucharest accounted for less than 4% of the total investment volume, mainly due to a very large retail portfolio transaction that closed during Q1 in various regional cities.

Market volumes were dominated by retail transactions (almost 95%), while office accounted for less than 4%. The largest transaction registered in the first quarter of 2019 was the acquisition of a retail portfolio, comprising 9 shopping centers totaling 68,000 sq. m in the regional cities of Romania.

The macro-economic forecast for Romania continues to be positive, despite some recent concerns.

On the financing side, terms and conditions are getting closer to what can be expected in the core CEE markets.

Consequently, sentiment is strong, with a total volume for 2019 estimated to surpass to the €1.1 billion mark. Prime office yields are at 7.25%, prime retail yields at 7.0%, while prime industrial yields are at 8.25%. Yields for retail are at the same level as 12 months ago, while office and industrial yields have compressed by 25 bps over the year. There is a very soft downward pressure on yields, however, in 2019 we do not expect any compression due to the lack of prime product transactions.

(Source: www.jll.ro)